Trusted Credit Unions in Cheyenne: Personalized Banking for Your Requirements

Empower Your Funds With a Federal Cooperative Credit Union

With an emphasis on providing competitive passion rates, personalized solution, and a diverse range of monetary items, government credit rating unions have actually emerged as a sensible alternative to conventional commercial banks. By diving right into the world of federal credit score unions, individuals can unlock a host of advantages that might simply transform the method they manage their funds.

Benefits of Joining a Federal Credit Rating Union

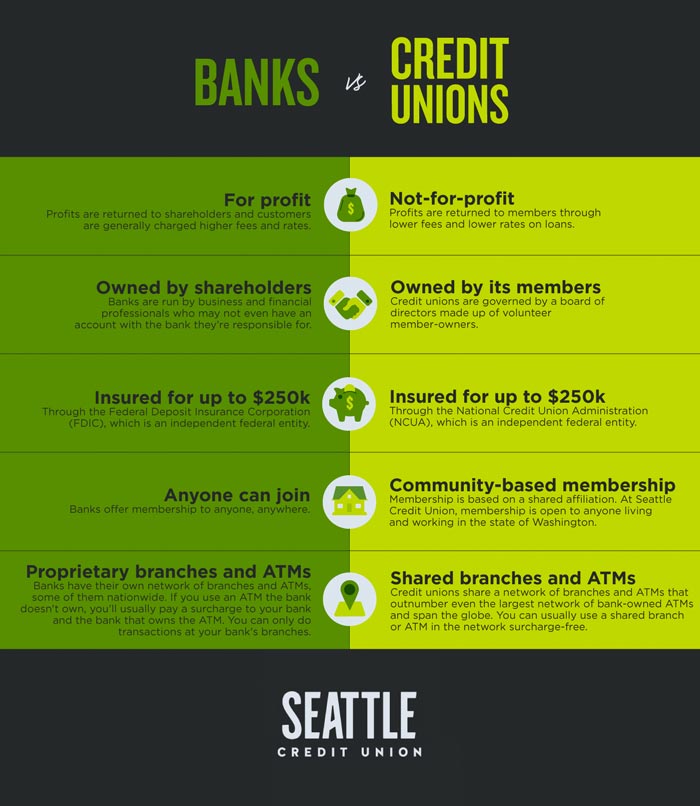

Signing up with a government credit rating union provides countless advantages for people seeking monetary security and tailored financial services. Among the key advantages is the member-focused technique that federal cooperative credit union provide. Unlike standard banks, federal cooperative credit union are not-for-profit companies had and run by their members. This framework allows them to focus on the economic well-being of their members above all else. Consequently, government credit rating unions typically supply reduced rate of interest on financings, greater rate of interest rates on cost savings accounts, and fewer fees contrasted to commercial banks.

Additionally, federal credit rating unions are understood for their phenomenal customer service. Whether it's using for a financing, establishing up a savings plan, or merely seeking financial recommendations, government credit report unions are devoted to giving the support and support that their participants require.

Exactly How to Sign Up With a Federal Lending Institution

To come to be a participant of a Federal Credit rating Union, people must fulfill specific qualification criteria established by the organization. These criteria generally include aspects such as area, employment status, subscription in particular companies, or belonging to a details area. Federal Credit history Unions are recognized for their inclusive membership policies, typically enabling individuals from a wide variety of backgrounds to join.

The initial step in signing up with a Federal Lending institution is to identify if you meet the eligibility demands stated by the organization. This details can normally be located on the cooperative credit union's website or by calling their membership department directly. Once qualification is verified, individuals can wage the membership application procedure, which may entail submitting an application kind and supplying proof of qualification.

After submitting the essential documents, the cooperative credit union will review the application and notify the person of their membership condition. Upon approval, new participants can start appreciating the services and advantages provided by the Federal Lending Institution. Signing Up With a Federal Cooperative credit union can provide people with accessibility to affordable financial items, individualized consumer service, and a sense of area participation.

Handling Your Cash Effectively

Reliable management of personal financial resources is critical for achieving long-term monetary stability and safety. To effectively handle your cash, beginning by developing a budget that describes your earnings and costs. This will certainly aid you track where your money is going and identify areas where you can potentially save. Setting economic objectives is one more crucial element of finance. Whether it's conserving for a large purchase, developing an emergency situation fund, or preparing for retired life, having clear objectives can direct your monetary decisions.

Frequently evaluating your financial situation is vital. Make the effort to evaluate your budget, track your spending, and make modifications as required. Think about automating your savings and costs repayments to guarantee you remain on track. It's likewise smart to construct a reserve to cover unforeseen expenses and stay clear of going into financial obligation. Furthermore, remaining notified regarding monetary matters, such as rate of interest, investment options, and credit report scores, can aid you make educated decisions and expand your wealth with time. By handling your money effectively, you can function towards attaining your monetary objectives and securing a stable future.

Financial Services Supplied by Federal Cooperative Credit Union

Federal credit rating unions offer a range of monetary services customized to satisfy the varied needs of their participants. These services typically include financial savings and examining accounts, finances for numerous purposes such as car lendings, home mortgages, personal loans, and bank card - Wyoming Federal Credit Union. Participants of federal lending institution can also take advantage of financial investment solutions, retirement preparation, insurance coverage products, and economic education resources

Among the essential advantages of using economic services used by federal cooperative credit union is the personalized method to participant needs. Unlike standard banks, credit history unions are member-owned, not-for-profit organizations that focus on the monetary wellness of their participants most of all else. This member-centric focus often equates right into reduced fees, affordable rates of interest, and a lot more flexible loaning terms.

Furthermore, government lending institution are recognized for their community-oriented ideology, often giving support and resources to help members attain their financial objectives. By supplying an extensive suite of financial services, federal cooperative credit union encourage their participants to make sound monetary choices and work towards a safe and secure financial future.

Optimizing Your Financial Savings With a Credit History Union

When seeking to optimize your savings method, discovering the possible advantages of aligning with a cooperative credit union can use useful chances for economic development and stability. Lending institution, as member-owned financial cooperatives, prioritize the health of their participants, commonly providing greater rate of interest on interest-bearing accounts contrasted to conventional financial institutions. By taking benefit of these competitive prices, you can make best use of the development of your financial savings gradually.

Additionally, cooperative credit union typically have reduced costs and account minimums, enabling you to maintain more of your financial savings functioning for you. Some lending institution even offer special financial savings programs or accounts made to aid participants get to certain monetary goals, such as conserving for a education, home, or retirement .

Additionally, lending institution are known for their personalized service and dedication to financial education and learning. By developing a partnership with your lending institution, you can access to skilled recommendations on conserving strategies, investment alternatives, and much more, encouraging you to make informed decisions that line up with your economic objectives. In general, optimizing your financial savings with a lending institution can be a smart and Credit Unions Cheyenne effective means to expand your wide range while securing your monetary future.

Verdict

To conclude, joining a government cooperative credit union can empower your financial resources by supplying reduced rates of interest on car loans, greater rates of interest on interest-bearing accounts, and personalized client service. By making the most of the economic solutions provided, managing your money effectively, and optimizing your cost savings, you can construct riches and protect your monetary future. Consider joining a federal cooperative credit union to experience the advantages of a member-focused technique to economic health.

Whether it's using for a finance, establishing up a cost savings strategy, or simply looking for monetary guidance, federal debt unions are dedicated to giving the assistance and assistance that their members need (Wyoming Federal Credit Union). Signing Up With a Federal Credit score Union can offer individuals with access to competitive economic products, individualized consumer service, and a feeling of neighborhood involvement

Federal credit history unions supply a range of monetary services tailored to meet the diverse demands of their members. Participants of federal credit scores unions can additionally benefit from investment solutions, retired life planning, insurance policy products, and monetary education resources.